Querco Fagetea

Querco Fagetea makes nature measurable, certifiable and investable.

We quantify the water services, biodiversity and carbon sequestration of forests using high-precision technology and have them certified by independent environmental experts. In this way, we are transforming a previously untapped potential – the entire ecosystem services of a forest – into a new, stable asset class. Our projects deliver financially marketable natural assets that can be accounted for, are regulatory compliant and generate clear ecological returns. QF provides investors with access to scalable natural capital that combines long-term performance, risk diversification and a genuine nature-positive impact.

QF: We make nature the asset class of the future. Nature measurable. Really valuable. Financially viable.

Querco Fagetea (QF) makes natural services – water storage capacity, biodiversity and CO₂ removal – visible, certifiable and investable.

We develop nature-based projects that are audited by independent environmental experts and bring forests into realization as a new asset class for the financial market.

→ Net Zero Water | Nature Credits | CO₂-Credits | Nature Capital Assets

We quantify and certify natural services using scientifically sound methods.

QF supports projects from conception to auditable certification:

● Net Zero Water – Water neutrality certificates

● Nature Credits for Biodiversity & Ecosystem Services

● Carbon Removal / CO₂-Credits

● Forests as investable natural capital

Our validated standards create trust and transparency for companies, forest owners, financial institutions and investors.

● Independent certification by environmental verifier and EY

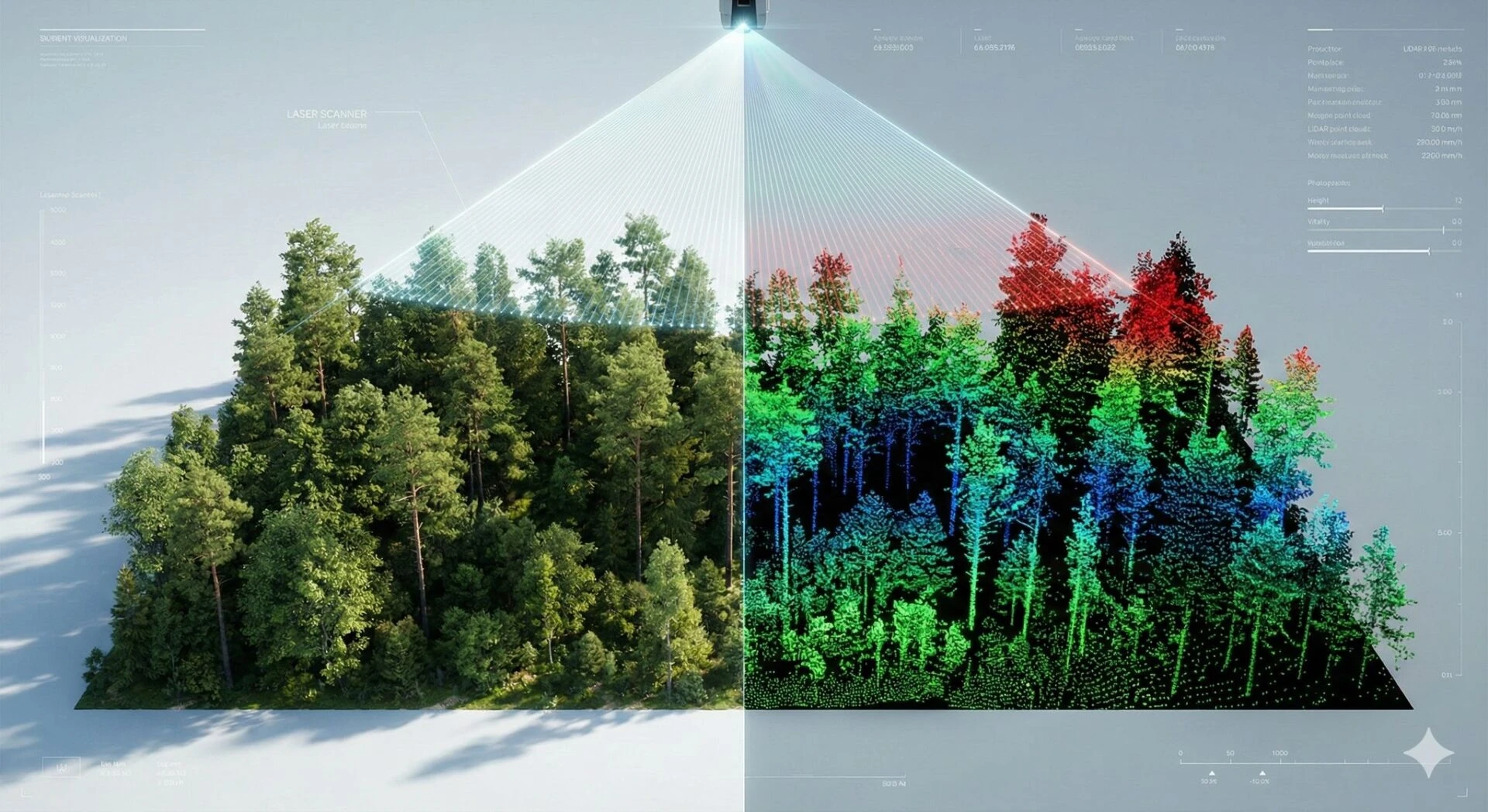

● Scientifically sound LiDAR, satellite & hydrology data

● Nature certificates suitable for the financial market

● Compatible with CSRD, EU Taxonomy & Green Claims

● Focus on long-term ecological & economic impact

Our mission

We are creating a future in which nature is not seen as a cost factor, but as strategic capital.

QF makes nature’s services measurable, assessable and tradable – and thus enables water stability, climate resilience and biodiversity in a financially viable way.

Our approach

QF combines ecology, technology and financial innovation:

● develop nature-based solutions

● Quantifying nature’s services scientifically

● arrange for independent certification

● Establishing natural capital as an asset class

Our values

● Transparency: All data can be audited

● Science: Research-based models & indicators

● Independence: Certification by external experts

● Impact orientation: Focus on real impact on nature

● Integrity: Strict compliance with regulatory standards

Develop natural capital now.

We develop projects that strengthen nature and companies and generate high-yield

natural assets.

Forest & Credits

as a new asset class

Nature becomes a strategic investment – ecologically and economically.

Carbon removal and nature credits are rapidly becoming a key component of corporate climate strategies. For companies that want to comply with legal requirements and ensure their future viability, they are no longer a “nice-to-have” – they are a must.

Carbon markets play a key role in achieving global climate targets. The agreement on Article 6 at COP29 and the introduction of a UN-backed global carbon market underline the regulatory tailwind for sustainable investments. At the same time, carbon pricing is becoming increasingly important with a view to net-zero targets by 2050 – as is the need to hedge against price fluctuations and future penalties at an early stage.

But a new playing field is emerging not only for regulators, but also for investors:

Forests and nature certificates are becoming the new asset class.

Using natural capital strategically

Our mission: to make the true value of nature visible, measurable and usable – as economically relevant natural capital for companies, forest owners and investors.

Our approach goes far beyond traditional carbon offsetting. We create nature-based assets that can be integrated into corporate strategies and balance sheets:

- Can be recognized in the balance sheet: Nature certificates, for example, can be classified as biological assets in accordance with IAS 41 – in contrast to traditional compensation approaches.

- Insurable: Our data provides a reliable basis for risk assessments by banks and insurance companies.

- Bankable: We make forests bankable – and therefore investable.

Valid data for valid decisions

The economic success of nature-based projects begins with precise recording. With our technology-supported approach, we create the conditions for reliable nature certificates:

- Precise nature assessment: We use LiDAR technology to measure forest and natural areas with millimeter precision – the basis for trustworthy assessments.

- Efficient data collection: Our scans record biomass, CO₂ storage and biodiversity quickly and reliably – for well-founded ecological and financial decisions.

- Optimized sustainability strategies: Companies receive reliable data to improve their climate strategy and comply with regulatory requirements.

- Financeable nature projects: Our analyses make nature values quantifiable – and thus usable for capital markets, banks and investors.

- Innovation for climate protection: We are developing new standards for nature credits – by combining cutting-edge technology with sustainable impact.

Nature conservation becomes a model for the future with QF

We combine ecological responsibility with economic added value,

for a climate-stable, investable and resilient nature.